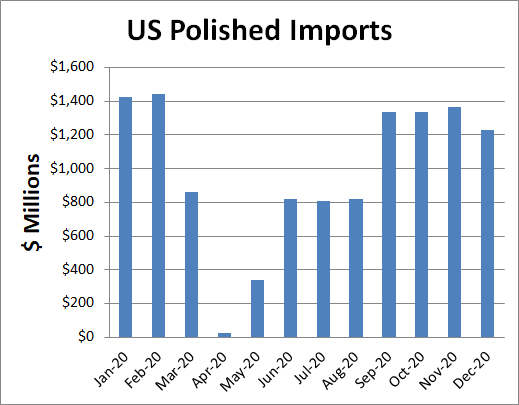

RAPAPORT... US polished-diamond imports fell 39% to $11.82 billion last year, reflecting heavy declines in the second quarter, according to data from the US Commerce Department. The slowdown eased in the latter part of the year, with December shipments slipping by just 2% year on year.

US Trade Data for December and FY 2020

| December 2020 | Year-on-year change | |

| Polished imports | $1.23B | -2% |

| Polished exports | $1.02B | -1% |

| Net polished imports | $212M | -10% |

| Rough imports | $53M | 10% |

| Rough exports | $55M | 51% |

| Net rough imports | -$1M | 2019: Surplus of $12M |

| Net diamond account | $211M | -15% |

| Polished imports: volume | 920,590 carats | 40% |

| Average price of polished imports | $1,335/carat | -30% |

| FY 2020 | Year-on-year change | |

| Polished imports | $11.82B | -39% |

| Polished exports | $10.1B | -42% |

| Net polished imports | $1.71B | -17% |

| Rough imports | $260M | -27% |

| Rough exports | $263M | -16% |

| Net rough imports | -$3M | 2019: Surplus of $43M |

| Net diamond account | $1.71B | -19% |

| Polished imports: volume | 7.1 million carats | -23% |

| Average price of polished imports | $1,654/carat | -21% |

Source: US Commerce Department data; Rapaport archives.

About the data: The US, the world’s largest diamond retail market, is a net importer of polished. As such, net polished imports — representing polished imports minus polished exports — will usually be a positive number. Net rough imports — calculated as rough imports minus rough exports — will also generally be in surplus. The nation has no operational diamond mines but has a manufacturing sector, so it normally ships more rough in than out. The net diamond account is total rough and polished imports minus total exports. It is the US’s diamond trade balance, and shows the added value the nation creates by importing — and ultimately consuming — diamonds.

Image: A polished diamond. (Shutterstock)

Source: Rapaport 24-02-2021