|

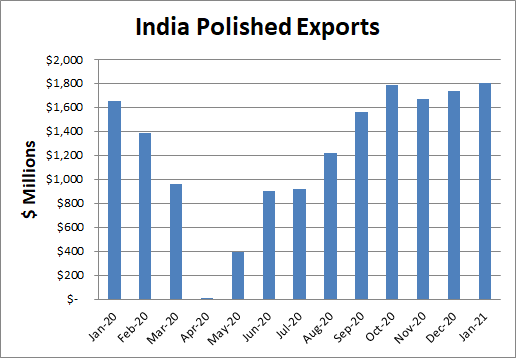

RAPAPORT... India has recorded its third consecutive monthly rise in polished-diamond exports, with shipments increasing 9% year on year to $1.8 billion in January. That followed gains of 42%

in November and 38% in December, reflecting a release of pent-up demand ahead of the US and Chinese holidays, as well as post-festival restocking. Rough imports jumped amid strong demand at

Alrosa and De Beers’ opening contract sales of 2021.

India Trade Data for January 2021

| |

January 2021 |

Year-on-year change |

| |

|

|

| Polished exports |

$1.8B |

9% |

| Polished imports |

$203M |

26% |

| Net polished exports |

$1.6B |

8% |

| Rough imports |

$1.26B |

65% |

| Rough exports |

$30M |

-60% |

| Net rough imports |

$1.23B |

78% |

| Net diamond account |

$375M |

-53% |

| Polished exports: volume |

2.3 million carats |

2% |

| Average price of polished exports |

$786/carat |

8% |

Source: Gem & Jewellery Export Promotion Council; Rapaport archives.

About the data: India, the world’s largest diamond-cutting center, is a net importer of rough and a net exporter of polished. As such, net polished exports — representing polished exports minus polished imports —

will usually be a positive number. Net rough imports — calculated as rough imports minus rough exports — will also generally be in surplus. The net diamond account is total rough and polished exports minus total imports.

It is India’s diamond trade balance, and shows the added value the nation creates by manufacturing rough into polished.

Image: A worker holding a diamond in an Indian polishing factory. (Shutterstock)

|